Viatical Settlement Ohio

Get Your Free Estimate!

Call us today at 877-261-0632

What is a Viatical Settlement?

A viatical settlement allows Ohio residents diagnosed with a life-threatening illness to receive immediate cash from your life insurance policy. Instead of waiting for a final benefit payout, the policy owner, you, can sell your coverage for an agreed amount, providing funds when they are most useful. We assume all future premium payments and become the new beneficiary.

Under Ohio state law, this transaction is a regulated financial process that treats the policy’s value as lawful consideration. Each application involves clear verification, review, and approval to ensure that you, the owner, receive fair and timely payment. The form and steps required are straightforward, with transparent communication at every stage to maintain security and compliance.

For people across Ohio, from Columbus to Cleveland, a viatical settlement represents action rather than waiting. It converts the cash surrender value of a life insurance policy into accessible funds that could reduce pressure from medical bills, strengthen family resources, and help sustain the quality of life you’ve built.

How Does a Viatical Settlement in Ohio Work?

A viatical settlement in Ohio begins when a life insurance policyholder requests to sell their policy for cash through a structured transaction. The process follows clear state requirements that protect you and makes sure everything is transparent and fair.

The application process starts with a simple request form. It includes details about the life insurance policy, the owner, and the life-threatening illness involved. Once submitted, our team verifies the connection between policy details and medical records to determine the policy’s face value, cash surrender value, and overall eligibility. This verification step ensures the information is accurate before any review or approval takes place.

Every life insurance policy is different, whether it’s Term Life, Whole Life, Universal, FEGLI, or Group coverage. We assess each one individually because factors such as premium payments, policy age, and loan provisions affect the final payout amount. Once verification is successful and all requirements are met, the policy owner, you, receives a document summarizing the offer and formally completes the transfer.

Ownership of the insurance policy then moves to us and the funds are paid directly to you in a single large lump-sum cash payment. The entire process is efficient and fully transparent, allowing Ohio residents to access the true cash value of their life insurance quickly.

It really is that simple!

Want a free estimate for your policy?

Use our free calculator to see if you qualify and get an estimate of your policy’s worth.

Who Is Eligible To Get A Viatical Settlement in Ohio?

Insured’s Health

To qualify for a viatical settlement, the insured must be diagnosed with a life-threatening illness such as cancer or ALS.

Policy Type

All life insurance policy types are accepted. Whether you have whole life, term life, universal, group, or joint life insurance, you could be eligible for a viatical settlement. However, if the policy is issued through an employer, the insured must be separated from the employer or nearing separation from their employer in order to sell their policy.

The Age Of The Life Insurance Policy

The life insurance policy must have been in place for at least two years.

The Value Of The Life Insurance Policy

The life insurance policy must have a face value of at least $200,000.

What are the Benefits of a Viatical Settlement in Ohio

There are many benefits of entering into a viatical settlement. However, the two most common reasons people do it are for the money and to ease the burden on their loved ones.

Some other benefits include:

- No medical exams are required

- You can use the money however you want

- It’s a speedy process

- You can choose the settlement company you want to work with

American Life Fund is one of the leading viatical settlement companies serving the citizens of the USA. We have helped many people through this difficult time in their lives.

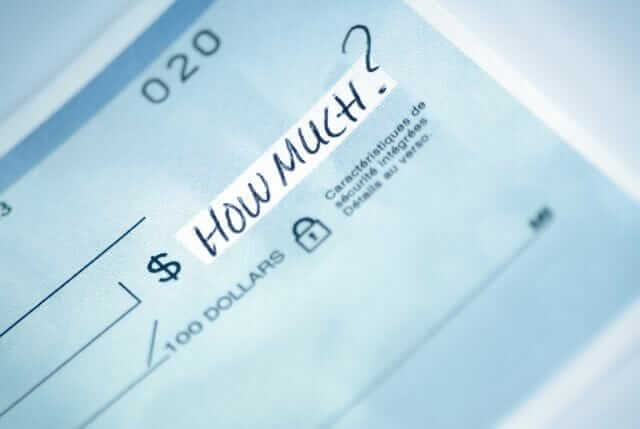

How are Viatical Settlement Payments Calculated?

The payout you receive from a viatical settlement is based on several factors, including but not limited to:

- The face policy value of your life insurance policy

- Your health condition

- The type of life insurance policy you have

These are just a few of the factors that will affect your payout. For an accurate and free quote, call us at 877-261-0632, and one of our expert representatives will be more than happy to help you.many people through this difficult time in their lives.

The Pros And Cons Of A Viatical Settlement for

Ohio Residents

Not sure if a viatical settlement is a right move for you or your loved one? Here are some things to keep in mind.

Pros:

- Receive a one-time payout that is typically much higher than the cash surrender value of your life insurance policy.

- Use the funds to cover medical expenses such as health insurance premiums, treatments, or long-term care.

- Have the flexibility to spend the money on better care, travel, or anything that improves your quality of life.

- Eliminate future life insurance premium payments, as the viatical settlement company takes over ownership and related costs.

Cons:

- Receiving a large payout could affect eligibility for need-based programs like Medicaid, which factor in income and assets.

- Once your policy is sold, beneficiaries will no longer receive the final payout unless you set aside a portion of your payout for them.

Why Clients Choose Us: At American Life Fund, we believe honesty and transparency aren’t optional—they’re the foundation of how we work. By choosing a trusted, licensed provider, you can avoid the pitfalls of the industry and move forward with confidence.

Viatical Settlement Examples

This is typically what a viatical settlement payout for a person from Ohio might look like:

- A life insurance policy with a $500,000 face value policy could yield a payout of around $300,000–$350,000, depending on health status and policy details.

- A policy with a $250,000 face value policy might provide a payout of $150,000–$175,000.

- A policy valued at $200,000 could result in a payout of $120,000–$140,000.

As you can see, viatical settlements can be very beneficial for seriously ill people who need financial assistance.

What About Life Settlements?

Viatical settlements and life settlements may sound similar but they are separate transactions. A life settlement is similar to a viatical settlement, but the two are distinct.

How do life settlements work?

- A life settlement is a transaction that occurs when an individual over 75 sells a life insurance policy to a settlement company for cash, usually yielding considerably more than the policy’s surrender value.

- This differs from the focus on a life threatening illness which is the main focus of a viatical

- The size of a life settlement payout is mostly determined by the policyholder’s health status and the premium payments of the policy. The money from selling life insurance policies can be used to finance long-term care, medical procedures, travel, or family events.

- Life settlements are usually subject to tax, while viaticals are usually tax-free

- Many people are unaware they can sell their life insurance policy for cash. When a policy becomes too expensive or unnecessary, the owner typically lets it lapse without knowing there is another option, the life settlement market.

Alternatives To Viatical Settlements

Not sure if a viatical settlement is right for you? Here are some other options to consider

Withdrawals

You can withdraw from the cash value of your life insurance policy, but this will reduce the death benefit paid to your beneficiaries.

Surrendering the policy

You can cancel your life insurance policy and receive the cash surrender value. This is usually a bad idea because you will get less money than if you had sold the policy in a viatical settlement.

Although viatical settlements offer many benefits, they aren’t the only form of financial assistance available. Be sure to speak with a professional before making any decisions.

Is a Viatical Settlement Right For You?

With life insurance policies increasing daily, it’s important to consider all options before deciding. For those with a chronic illness, selling your policies may be one way to afford quality care while still securing a financial cushion that will help you improve your quality of life.

If you or a loved one is facing a life-threatening illness and needs a Viatical Settlement, please call us at 877-261-0632 to see how we can help.

We’ve Helped Thousands of

People Just Like You.

“You never know how stressful a cancer diagnosis is until you experience it yourself. American Life Fund relieved my financial worries so I’m able to focus on my journey to recovery!”

Andrea, Arizona

“Once I received the first bill for treatments, I knew that I had to come up with a financial plan. I found American Life Fund and instantly felt reassured that I was in good hands. They were able to provide me with the money I needed and literally saved me from bankruptcy. I am now able to enjoy my time with what means the most to me, my family.”

Dan, Alabama

“When my husband was diagnosed with cancer and our retirement ran out, we needed a plan B and fast. American Life Fund provided the financial help we needed exactly when we needed it.”

Charlene, Wisconsin

Ohio Counties Eligible for Viatical Settlements

Adams, Allen, Ashland, Ashtabula, Athens, Auglaize, Belmont, Brown, Butler, Carroll, Champaign, Clark, Clermont, Clinton, Columbiana, Coshocton, Crawford, Cuyahoga, Darke, Defiance, Delaware, Erie, Fairfield, Fayette, Franklin, Fulton, Gallia, Geauga, Greene, Guernsey, Hamilton, Hancock, Hardin, Harrison, Henry, Highland, Hocking, Holmes, Huron, Jackson, Jefferson, Knox, Lake, Lawrence, Licking, Logan, Lorain, Lucas, Madison, Mahoning, Marion, Medina, Meigs, Mercer, Miami, Monroe, Montgomery, Morgan, Morrow, Muskingum, Noble, Ottawa, Paulding, Perry, Pickaway, Pike, Portage, Preble, Putnam, Richland, Ross, Sandusky, Scioto, Seneca, Shelby, Stark, Summit, Trumbull, Tuscarawas, Union, Van Wert, Vinton, Warren, Washington, Wayne, Williams, Wood, Wyandot

Viatical Settlement Franklin County

Columbus stands at the center of Ohio’s medical progress, home to OhioHealth and the Ohio State University Wexner Medical Center. Many patients undergoing advanced treatment here face rising costs that insurance cannot fully cover. A viatical settlement gives residents the power to convert the face value of their life insurance into accessible cash, reducing the pressure of ongoing medical bills. The process is straightforward, and every step is carefully verified to ensure fair value and fast payment.

Viatical Settlement Cuyahoga County

Cleveland is known for the Cleveland Clinic, one of the world’s leading centers for neurology and complex disease treatment. Residents here often seek progressive therapies that bring hope, but also a heavy expense. Through a viatical settlement Ohio, a policy owner can unlock the cash surrender value of their insurance policy, turning years of premium payments into financial relief.

Viatical Settlement Hamilton County

Cincinnati’s strong community spirit and world-class hospitals, including UC Health and Christ Hospital, give residents access to some of the best medical teams in the Midwest. Yet even with top-tier care, the financial strain of life-threatening illness can grow quickly. A viatical settlement provides a legal and regulated way to sell a life insurance policy for cash, allowing policyholders to maintain control over how they use their funds.

Viatical Settlement Lucas County

In Toledo, a city where steady work and strong values shape daily life, many residents face healthcare challenges with quiet determination. The viatical settlement process gives them a practical path to stability. Once an application form is verified and approved, the owner receives a lump-sum payment equal to a percentage of the policy’s face value. Those funds can cover hospital care, in-home assistance, or simply create breathing space to recover without financial fear.

Viatical Settlement Summit County

Akron combines close-knit neighborhoods with access to leading regional hospitals such as Summa Health and Cleveland Clinic Akron General. A viatical settlement allows local policyholders to transform their life insurance into cash when it’s needed most. This transaction provides financial flexibility for everything from loan repayment to family support.

Viatical Settlement Montgomery County

Ohio residents face significant challenges when it comes to healthcare costs. According to a 2024 Healthcare Value Hub survey, 80% of adults in Ohio reported concern about affording medical care now or in the future, while 36% said they had experienced a direct financial burden from medical bills within the past year. These costs often extend beyond hospital stays to include prescription drugs, home care, and ongoing treatment expenses, creating lasting pressure on both patients and families.

Insights for Viatical Settlements in Ohio

Ohio residents face significant challenges when it comes to healthcare costs. According to a 2024 Healthcare Value Hub survey, 80% of adults in Ohio reported concern about affording medical care now or in the future, while 36% said they had experienced a direct financial burden from medical bills within the past year. These costs often extend beyond hospital stays to include prescription drugs, home care, and ongoing treatment expenses, creating lasting pressure on both patients and families.

Beginning in 2025, the Ohio Hospital Price Transparency Act requires hospitals statewide to publish clear, itemized lists of service prices. The goal is to help patients compare costs before treatment and reduce financial surprises after care. Yet, even with transparency and insurance coverage, many Ohioans continue to face steep out-of-pocket costs, particularly when managing long-term or serious illnesses.

For individuals living with a life-threatening illness, the financial weight of care can escalate quickly. A viatical settlement offers one of the few options for immediate financial relief, allowing the policy owner to sell their life insurance policy for a lump-sum payment that often exceeds the cash surrender value. The funds can then be used for medical bills, caregiving support, home modifications, or simply to improve quality of life during treatment.

For many in Ohio, transforming an existing life insurance policy into usable cash provides not just stability, but control. It means covering necessary care without waiting for a death benefit, maintaining security for loved ones, and preserving personal choice in how each dollar is spent.

FAQ about Viatical Settlement in Ohio

How does the viatical settlement process work in Ohio?

A viatical settlement in Ohio is a documented transaction where a policy owner sells a life insurance policy for cash. The value is based on the policy’s face value, premium payments, and current medical records. Once an application is submitted, each form is verified, reviewed, and approved under state requirements. When contracts are signed, the funds (up to 70% of the face value) are paid directly to the owner.

Are viatical settlement payouts taxable in Ohio?

Under federal law, viatical settlement proceeds are not taxable when the insured is diagnosed with a life-threatening illness. The full payment can be used immediately to cover medical expenses, daily living costs, or family care or however you like. This makes it one of the few forms of financial relief that remains both accessible and tax-free.

How long does it take to receive payment?

Once verification and review are complete, most Ohio residents receive their payout within two to three weeks. Timing depends on how quickly medical records and policy information are confirmed. The goal is always to move from application to approved transaction as efficiently as possible.

Can I change my mind after agreeing to a settlement?

Yes. Ohio law provides a rescission period of 15 days after receiving funds. If the policy owner decides not to proceed, they can return the payment and retain the insurance policy. This provision allows every person entering a viatical settlement Ohio to make a confident, informed choice.

What happens to my premiums after the sale?

Once the contract is complete, we take over all future premium payments. You no longer carries any financial responsibility for maintaining the policy, and the cash received remains entirely yours.

How is privacy protected during the process?

All medical records, financial data, and identifying information are kept strictly confidential. These protections follow both Ohio state law and national standards for patient privacy.

How does the face value of a life insurance policy affect the payout?

The face value serves as the foundation for calculating what a policy is worth on the secondary market. Higher face values and consistent premium payments typically yield stronger offers. Every evaluation uses verifiable data to determine fair compensation and to ensure you receive full and lawful value consideration. Call us on (877) 261-0632 to learn more.

What happens if my health changes after selling the policy?

After the settlement is finalized, we assume all future financial risk. If health improves, the cash payment remains yours. If the condition worsens, it does not alter the amount you received. The transaction is complete once the funds are transferred.

Why do people in Ohio choose viatical settlements?

Many turn to viatical settlements when faced with high care costs, limited insurance coverage, or the need for immediate cash. It converts an intangible insurance asset into usable funds that can improve your life quality, reduce financial stress, and offer flexibility that traditional final payouts cannot provide during your lifetime.

Get a personalized Viatical Settlement estimate.

We will get you the best possible offer for your policy.