New Jersey Counties Eligible for Viatical Settlements

Atlantic, Bergen, Burlington, Camden, Cape May, Cumberland, Essex, Gloucester, Hudson, Hunterdon, Mercer, Middlesex, Monmouth, Morris, Ocean, Passaic, Salem, Somerset, Sussex, Union, and Warren.

Viatical Settlement Bergen County

If you’re in Bergen County and considering a viatical settlement, we’re here to support you. Our dedicated team provides compassionate and thorough assistance, guiding you through the complexities of viatical settlements. We work closely with you to make sure that you fully understand your options, empowering you to make informed decisions about your financial future.

Viatical Settlement Middlesex County

Dealing with a serious illness is challenging, and at American Life Fund, we’re here to help residents of Middlesex County navigate this difficult time. If you’re exploring viatical settlements, our experienced team offers the support and guidance you need. We strive to simplify the process, providing clear information and personalized assistance, so you can make the best choices for your financial well-being.

Viatical Settlement Essex County

For those in Essex County facing a life-threatening illness, American Life Fund is here to provide the necessary support. Considering a viatical settlement is a big first step to guaranteeing your financial future, and our knowledgeable team is dedicated to helping you through every stage. We offer compassionate guidance and guarantee you understand your options, allowing you to make well-informed decisions about your financial situation.

Viatical Settlement Hudson County

At American Life Fund, we understand the difficulties that come with managing a serious illness. If you’re in Hudson County and looking into viatical settlements, our team is here to assist you. We specialize in offering empathetic and thorough support, helping you work through the challenges of the process. Our goal is to provide you with all the information you need to make informed and confident decisions about your financial future.

Viatical Settlement Monmouth County

Facing a life-threatening illness is tough, but residents of Monmouth County have a reliable partner in American Life Fund. If you’re considering a viatical settlement, our dedicated team is here to offer compassionate and expert guidance. We are committed to simplifying the process for you, ensuring you understand your options and can make decisions that best suit your financial needs.

Viatical Settlement Ocean County

American Life Fund is here to support residents of Ocean County dealing with serious illnesses. If you’re contemplating a viatical settlement, our experienced team is ready to provide the assistance you need. We focus on offering empathetic support, guiding you through the process and helping you understand your options, so you can make informed choices about your financial future.

Insights for Viatical Settlements in New Jersey

New Jersey’s population reached approximately 9.29 million as of 2023, reflecting a modest growth since 2020. Of this population, about 17.4% are seniors aged 65 and older, who often face increasing healthcare needs and costs as they age.

Regarding health, about 6.8% of New Jersey’s population under the age of 65 live with a disability, and 8.0% are without health insurance. This highlights a large enough portion of the population that might face medical and financial challenges without adequate coverage.

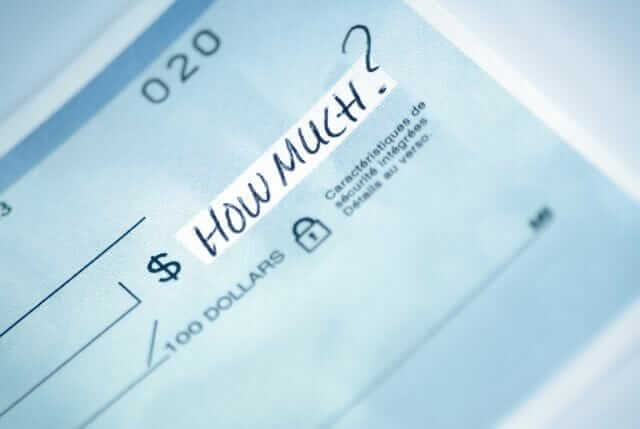

According to Genworth’s 2024 report, the average cost of assisted living in New Jersey is $6,495 per month. These figures show the potential financial strains that individuals, particularly the elderly or those with severe health conditions, might face in New Jersey.

A study on the Prevalence and Medical Costs of Chronic Diseases Among Adult Medicaid Beneficiaries revealed that costs among beneficiaries with cancer were between $30,540 and $47,850 for the six months following diagnosis. Clearly, a monthly pension is not enough to handle everything.

A viatical settlement could offer a necessary financial lifeline by providing a lump sum cash payment, allowing for better management of healthcare costs, living expenses, or even fulfilling personal goals during challenging times. This financial option is particularly beneficial for those in New Jersey who are struggling to cover the high costs of medical care and living expenses due to a serious illness.

FAQ about Viatical Settlement in New Jersey

Who is eligible for a viatical settlement in New Jersey?

In New Jersey, individuals diagnosed with a life-threatening illness, usually with a life expectancy of two years or less, are eligible for viatical settlements. The policyholder must have a valid life insurance policy to sell.

How much can I expect to receive from a viatical settlement?

The amount you receive from a viatical settlement depends on several factors, including the policy’s death benefit, your life expectancy, and the terms of your policy. Typically, the payout is higher than the policy’s cash surrender value but less than the death benefit.

Are viatical settlement proceeds taxable in New Jersey?

In most cases, the proceeds from a viatical settlement are not subject to federal income tax if the policyholder is seriously ill. However, it’s advisable to consult with a tax professional for specific guidance related to your situation.

How long does the viatical settlement process take?

The viatical settlement process typically takes several weeks to complete. This includes the time needed for the policy review, medical records assessment, and finalizing the agreement.

Can I still receive my death benefit if I opt for a viatical settlement?

Once you complete a viatical settlement, the purchaser becomes the new owner and beneficiary of the life insurance policy. This means you will no longer receive the death benefit, but you will receive an immediate lump sum payment instead.

How can I ensure I’m working with a reputable viatical settlement provider in New Jersey?

To guarantee that you are working with a reputable provider, check for proper licensing and accreditation. It’s also beneficial to read reviews and seek recommendations. At American Life Fund, we are committed to providing transparent and trustworthy services to our clients.