Understanding life expectancy is more than just knowing the numbers; it’s about planning your future wisely. By being aware of how long you might live, you can make smarter decisions about your finances, from choosing the right life insurance policy to planning your retirement.

Insurance companies use this data to determine premiums, and for you, it lays the groundwork for securing your family’s financial future and your own peace of mind. Whether it’s saving for an extended retirement or ensuring your loved ones are taken care of after you’re gone, understanding life expectancy helps you prepare for the long run, ensuring you make the most of your years ahead.

What Is Life Expectancy?

Life expectancy is the statistical age at which a person is expected to live based on various factors, including age, gender, and mortality rates. Life expectancy is a critical metric that significantly shapes various aspects of our lives, particularly financial planning and life insurance.

The life expectancy calculation is not a random guess; it relies on extensive data collected and analyzed by national statistical agencies. To arrive at accurate estimates, these agencies consider many variables, such as historical mortality rates, demographic trends, and population health data.

Several components influence life expectancy, making it a dynamic figure. Lifestyle choices, genetics, access to healthcare, and medical advances all contribute to the variations in life expectancy across different groups and regions.

For insurance companies, life expectancy is a vital consideration. They use actuarial tables, which are mathematical models, to assess the risk associated with insuring individuals. By doing so, insurance companies aim to minimize liability risks and set appropriate premiums for policyholders.

Understanding your life expectancy is significant for making informed decisions about your financial future and insurance needs. It provides a foundation for planning your retirement, managing your investments, and ensuring that you and your loved ones are financially secure in the years to come.

What Is the Average Life Expectancy in the US?

Life expectancy at birth is a key demographic indicator that provides valuable insights into a population’s overall health and well-being. In the United States, organizations such as the Centers for Disease Control and Prevention (CDC) closely monitor and analyze life expectancy figures.

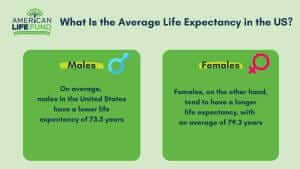

As of the latest available data from the CDC, the average life expectancy in the United States stands at 76.4 years for both sexes. However, when broken down by gender, we see slight variations:

- Males: On average, males in the United States have a lower life expectancy of 73.5 years.

- Females: Females, on the other hand, tend to have a longer life expectancy, with an average of 79.3 years.

These statistics are not static and can change over time due to various factors, including healthcare advances, lifestyle changes, and responses to public health challenges. The CDC continually monitors and updates these figures to accurately assess life expectancy trends in the United States.

Understanding the average life expectancy in the US is essential for policymakers, healthcare providers, and individuals alike. It serves as a baseline for assessing the effectiveness of public health initiatives, planning for health care resources, and making informed decisions about personal finances, retirement, and life insurance.

You can refer to the CDC’s official sources and publications for the most up-to-date information on life expectancy in the US.

What are the Factors Affecting Life Expectancy?

Life expectancy, a crucial metric in the institute of insurance and personal financial planning, is influenced by a multitude of variables. The two most significant are the time you were born and your gender. These variables lay the foundation for understanding individual life expectancy, impacting insurance risk assessment and premium calculations.

Intriguingly, life expectancy isn’t set in stone but evolves as we age. For instance, as individuals outlive younger generations, their life expectancy can increase. This dynamic aspect highlights the importance of regularly reassessing one’s insurance needs and financial planning as one progresses through life.

However, beyond the fundamental factors of birth year and gender, other variables come into play. These include race, personal health, family medical history, and lifestyle choices. Risky behaviors like smoking, excessive alcohol consumption, and a sedentary lifestyle can significantly reduce life expectancy.

To gain a more comprehensive understanding of the factors affecting life expectancy, you can turn to national institute and federal government data. The National Center for Health Statistics and the Social Security Administration’s Actuarial Period Life Table provide valuable insights into trends and projections. These resources help insurance companies assess risks and determine appropriate premiums for life insurance policies.

Notably, human life expectancy has witnessed remarkable increases over the past two centuries, particularly in developing countries. Advances in healthcare, sanitation, and living conditions have contributed to this positive trend. However, the interplay of various factors ensures that life expectancy remains a dynamic and multifaceted metric, underscoring its significance in insurance and financial planning.

How does Life Expectancy influence Life Insurance?

Life insurance, a crucial financial tool for safeguarding your family’s future, is intimately tied to life expectancy. Understanding how life expectancy influences health care and life insurance can help you make informed decisions about your coverage.

Insurance companies rely on actuarial tables to estimate the life expectancy of their policyholders. Life expectancy is the primary factor in determining an individual’s risk of making a claim. This estimation allows insurers to predict how much they may need to pay out in claims over the life of a policy.

Various factors, including age, lifestyle choices, family medical history, and other health-related variables, influence premium rates for life insurance policies. These factors are assessed based on the statistical average number for individuals with similar ages and health profiles. Younger individuals generally have a healthy life expectancy, which translates to lower insurance costs.

Here’s a key point: purchasing life insurance at a younger age often results in lower risk for the insurer and lower premiums for the individual. Your life expectancy may decrease as you age, and this increased risk is reflected in higher premium rates. Therefore, waiting to buy life insurance leads to higher costs due to the decreased life expectancy associated with aging.

Additionally, buying life insurance earlier has long-term benefits. It secures your coverage at a more affordable rate and allows you to build policy value over time. This can be a valuable asset for your future or provide additional financial security for your loved ones in the event of your passing.

Life insurance and life expectancy are intricately linked. By understanding how life expectancy influences life insurance premiums, you can make informed choices about when and how to secure the coverage that best meets your needs and financial goals.

How does Life Expectancy Affect Retirement Planning?

Life expectancy plays a pivotal role in shaping the contours of retirement planning. Whether you’re meticulously crafting a retirement strategy or considering annuity contracts, understanding the implications of your life expectancy is essential for financial security during your golden years.

One of the critical aspects influenced by life expectancy is the nature of your retirement plan. With a longer life expectancy, you may need to prepare for a more extended retirement period, requiring careful financial management to ensure your resources last.

When negotiating annuity contracts, it’s crucial to consider how long you might live. An annuity is a financial product that provides regular payments in exchange for a lump-sum investment. Your life expectancy directly affects the amount you receive in these payments, making it a vital factor to consider when making these arrangements.

For many retirees, relying on a fixed income can be challenging, especially if they underestimate their life expectancy. This leads to financial strain in later years when additional income may be needed.

For couples, it’s essential to consider both partners’ life expectancies when planning for retirement or annuity contracts. The financial needs of the surviving spouse should be factored into the plan to ensure they are adequately provided for.

Interestingly, a report from the TIAA Institute and George Washington University revealed a concerning trend. This report showed that over half of American adults aren’t aware of the typical retirement lifespan. Many individuals may live longer than they think and not save enough to sustain their retirement for the entire duration. This underscores the importance of being well-informed about life expectancy and its impact on retirement planning.

Living longer increases exposure to inflation risk. Low-yielding investments might not keep pace with rising inflation, potentially making your retirement income inadequate for maintaining your desired lifestyle. To address this, retirees may need to consider investment strategies that provide a hedge against inflation.

Life expectancy isn’t just a statistic; it’s a critical factor that should inform your retirement planning decisions. Whether you’re considering annuities, managing your investments, or crafting a comprehensive retirement strategy, understanding the potential duration of your retirement is vital for financial readiness and security.

How Does Life Expectancy Affect Taxes?

Life expectancy isn’t just a consideration for financial planning; it also has implications for your tax obligations during retirement. The Internal Revenue Service (IRS) employs actuarial tables to estimate lifespan, and this estimation plays a significant role in determining required minimum distributions (RMDs) from specific tax-advantaged retirement accounts.

As you plan for retirement, it’s crucial to know that RMDs come into play at a specific age—73. These mandatory withdrawals ensure that individuals with tax-advantaged retirement accounts, such as traditional IRAs and 401(k)s, begin taking distributions from these accounts. The purpose of these RMDs is to collect the deferred tax revenue on these accounts gradually.

The IRS actuarial tables help calculate the annual RMD amount you must withdraw from your retirement accounts. Your life expectancy is a key factor in this calculation. Essentially, the IRS considers your expected lifespan to determine how much of your retirement savings you should distribute each year to meet tax obligations.

Understanding the relationship between life expectancy and taxes is essential for effective retirement planning. Failing to comply with RMD requirements can result in penalties while optimizing your RMD strategy can help minimize your tax liability during retirement.

Life expectancy has a direct impact on your tax obligations in retirement. Being aware of the IRS actuarial tables and the age at which RMDs kick in helps you make informed decisions about when and how to withdraw funds from your tax-advantaged retirement accounts while ensuring compliance with tax regulations.