When protecting your family’s financial well-being, choosing the right amount of life insurance is not a matter of guesswork. It requires carefully assessing various factors, including your current financial situation, family needs, and long-term financial goals. Fortunately, there are practical steps you can follow and specialized tools like life insurance calculators to help you arrive at an accurate figure. Below, we will break down the process of calculating your life insurance needs into clear, actionable steps, ensuring that you can make an informed decision that safeguards your loved ones’ future.

How Much Life Insurance Do I Need?

Determining the right amount of life insurance isn’t a one-size-fits-all task. It’s a process that depends on various factors geared toward ensuring that your family’s financial needs are met if you were to pass away unexpectedly. Here’s how to calculate your life insurance needs effectively:

Step 1: Evaluate Your Financial Situation

Before diving into the calculation, take a moment to assess your current financial state. This includes:

- Annual Income (FS): Begin with your annual income. Most insurance companies suggest that your life insurance policy should be worth 10 to 12 times your yearly earnings. This provides a solid foundation for your coverage amount.

- Existing Debts (PAA): Account for any outstanding debts you have. This could include a mortgage, car loans, credit card balances, and other loans. You’ll want to make sure that your life insurance can cover these debts to prevent burdening your loved ones with financial obligations.

Step 2: Define Your Objectives

Consider the primary purpose of your life insurance. People have various needs, and your coverage should align with your goals. Here are some key considerations:

- Daily Expenses: Do you want your life insurance to cover your family’s everyday expenses, allowing them to maintain their current standard of living if you were to pass away unexpectedly?

- Debt Payoff: One of your primary goals is to pay off your home mortgage and other debts so that these financial obligations don’t burden your loved ones.

- Education Fund: Are you looking to secure your children’s educational future, such as covering college tuition costs?

- Funeral and Final Expenses: Do you want to ensure that your life insurance can handle your funeral and other final expenses, sparing your family from these immediate costs?

Step 3: Calculate Your Coverage Needs

Now that you’ve identified your objectives, it’s time to calculate your life insurance coverage needs. To do this, add up the following:

- Annual Income Replacement: Multiply your annual income by 10 to 12, as most insurance companies suggest.

- Debt Obligations: Total the outstanding debts you want your life insurance to cover.

- Education Fund: Calculate the estimated costs of your children’s education if this is a priority.

- Final Expenses: Include the anticipated costs of your funeral and any other immediate expenses.

By adding up these components, you’ll arrive at a ballpark figure for your life insurance needs. Remember that these are general guidelines, and your circumstances may require adjustments. It’s always a good idea to consult a financial advisor or insurance expert to ensure you have the right coverage tailored to your unique situation.

How Can I Calculate My Life Insurance Needs?

There are multiple ways to calculate your life insurance needs, and it’s essential to consider this task carefully. The right coverage amount can provide your loved ones peace of mind and financial security.

10-times income guideline

The “10 times income” guideline is a commonly heard rule of thumb when determining the minimum life insurance policy value. This approach suggests that your life insurance coverage should equal ten times your annual income. While this guideline is straightforward, it’s important to understand its limitations.

The “10 times income” guideline is a simplified approach that may not comprehensively assess your family’s specific needs. It doesn’t consider your savings, existing insurance policies, or the unique circumstances of your household.

One significant consideration often overlooked is the value of stay-at-home parents or caregivers. Even if they don’t have an income, their work—such as childcare and household management—holds immense value. In the event of their passing, the remaining parent may need to cover the cost of these services, which should be factored into the insurance equation.

Consider adding $100,000 per child for future college expenses to provide a more practical and tailored approach. This supplement to the “10 times income” rule considers your children’s educational needs. It adds a layer of financial security to your coverage.

It’s important to understand that this more refined method still has limitations. It doesn’t comprehensively assess all your family’s needs, assets, or current life insurance coverage. For a more precise calculation, it’s advisable to consult with a financial advisor or insurance expert who can consider your unique circumstances and help you determine the ideal coverage amount.

Years-Until-Retirement Method

Another method to calculate your life insurance needs is the “Years-Until-Retirement” approach. This method simplifies the calculation by multiplying your annual salary by the number of years left until your planned retirement age.

For example, let’s say you’re a 40-year-old earning an annual salary of $60,000 and plan to retire at age 65. Using this method, you would calculate your life insurance needs by multiplying your remaining working years (25 years) by your annual salary ($60,000), which equals $1,500,000.

This approach provides a straightforward way to estimate your coverage requirements based on your income and how many years you intend to work before retiring. However, similar to the “10 times income” guideline, it’s essential to recognize that this method may not account for all the nuances of your financial situation, such as existing debts, savings, or specific family needs.

It’s a good starting point for a rough estimate, but for a more accurate and comprehensive assessment, considering additional factors and consulting with a financial advisor or insurance expert is advisable. They can help you tailor your life insurance coverage to your unique circumstances and financial goals.

The DIME Method

The DIME method is a comprehensive way to calculate your life insurance needs by considering four crucial areas of financial security:

- Debt: Begin by summing up all your outstanding debts, excluding your mortgage. Additionally, include an estimate for funeral costs, as these are immediate expenses that your life insurance should cover.

- Income: Determine how many years your family would require financial support in your absence. Multiply your annual salary by that number to ensure your loved ones can maintain their standard of living.

- Mortgage: Calculate the amount needed to pay off your home loan entirely. This ensures that your family won’t risk losing their home due to financial constraints.

- Education: Consider the expected tuition, room, and board costs for each child planning to attend college. This element of the DIME Method helps secure their educational future.

The DIME method helps you figure out how much life insurance you need. Just add up your debts (not including your mortgage), multiply your yearly income by how long your family would need support, include your mortgage payoff, and estimate your children’s education costs. This total gives you your estimated insurance coverage.

Standard-of-Living Method

The Standard-of-Living Method, often referred to as the Human Life Value (HLV) approach, is a calculation method that strongly emphasizes securing the long-term financial well-being of your loved ones in the event of your passing.

This method takes into account several key factors:

- Maintaining the Status Quo: The primary objective is to calculate the amount of money your survivors would require to sustain their current standard of living if you were no longer there to provide financial support.

- Coverage Determination: To determine the needed insurance coverage, the standard-of-living amount is multiplied by a factor of 20. This multiplier ensures that survivors can withdraw 5% from the death benefit each year, approximately equivalent to their standard-of-living expenses.

- Investment Strategy: The method assumes that the remaining death benefit principal can be invested to generate 5% or better returns. This investment approach is integral to sustaining the funds over time, thereby safeguarding your family’s financial future.

By utilizing the Standard-of-Living Method, you’re making a conscious effort to ensure that your loved ones can enjoy the same quality of life they are accustomed to, even after you’re gone. It’s a strategy prioritizes long-term financial sustainability for survivors, providing peace of mind and financial security.

Shortfall calculation

The Shortfall Calculation method offers a pragmatic way to determine your life insurance needs by focusing on bridging the income gap for your family in the event of your passing. It considers various income sources and assets to assess your coverage requirements comprehensively.

Here’s how it works:

- Desired Annual Income: Begin by identifying the annual income you’d like to leave behind for your spouse and family for a specific number of years. This amount should consider their financial needs and maintain their current standard of living.

- Subtract Other Income Sources: Deduct all available annual income sources that your family could rely on after your passing. This might include retirement accounts, pension benefits, personal savings, your spouse’s salary, and Social Security payments. The result of this subtraction reveals the income gap, or shortfall, that your life insurance policy needs to address.

- Incorporate All Assets: When calculating your shortfall, consider all your assets, including investments, real estate, and other valuable holdings. Assets can change over time, so it’s essential to have a holistic view of your financial situation.

- Future Asset Considerations: If you are still in the early stages of saving for retirement or expect your assets to grow significantly, factor in these potential earnings when determining your life insurance needs. Your policy should be flexible enough to account for changing circumstances.

The Shortfall Calculation method offers a practical approach to life insurance planning, as it directly addresses the income gap that your family may face without your financial support. It’s a versatile method that can adapt to your evolving financial situation and aspirations.

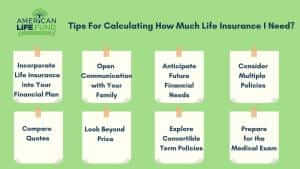

Tips For Calculating How Much Life Insurance I Need?

When calculating your life insurance needs, several important considerations can help ensure that you make informed decisions tailored to your unique situation. Here are some valuable tips and advice:

- Incorporate Life Insurance into Your Financial Plan: View life insurance as an integral part of your broader financial strategy, especially when considering future expenses such as college tuition and potential income growth.

- Open Communication with Your Family: Engage in open discussions about the coverage amount with your family. Ensuring that everyone’s expectations align can prevent misunderstandings in the future.

- Anticipate Future Financial Needs: Don’t underestimate your future financial needs. Both income and expenses will likely increase over time, so consider these factors when determining your coverage.

- Consider Multiple Policies: Splitting your coverage between multiple policies can provide flexibility to address different durations and specific needs.

- Compare Quotes: Obtain quotes from different life insurance providers. Comparing policies can give you an idea of the cost variations and available options.

- Look Beyond Price: While price is important, it shouldn’t be the sole deciding factor when purchasing life insurance. Consider future health needs and the flexibility offered by the policy.

- Explore Convertible Term Policies: Term life insurance policies that offer the option to convert to permanent insurance can provide added flexibility for changing circumstances.

- Prepare for the Medical Exam: If your insurance requires a medical exam, prepare well. Small adjustments to your daily routine and diet leading up to the exam can positively impact the results, potentially resulting in better quotes.

By following these tips and considering all aspects of your financial situation and future needs, you can make a well-informed decision when calculating how much life insurance you need. It’s a crucial step toward ensuring the financial security of your loved ones in the years to come.

What Other Factors Should I Consider When Buying Life Insurance?

When purchasing life insurance, it’s essential to consider various factors to ensure your policy aligns with your specific needs and circumstances. Here are some additional factors to keep in mind:

- Child Care Costs: If you have children, factor in the cost of childcare when determining your life insurance coverage. Childcare expenses can be significant and should be considered to provide for your children’s well-being.

- Funeral Expenses: The cost of a funeral can be substantial. The national median cost for a funeral is approximately $7,848. Considering this expense in your life insurance coverage can ease the financial burden on your loved ones during a difficult time.

- Term vs. Permanent Life Insurance: Decide between term and permanent life insurance based on your financial situation and goals. Term life insurance is typically more affordable and provides coverage for a specific duration. On the other hand, permanent life insurance often includes a cash value component but tends to be more expensive. Consider factors such as affordability and the duration of coverage that best suits your needs.

- Life Insurance Riders: Explore adding life insurance riders to customize your policy. These riders can provide additional benefits or coverage for specific situations. The availability of riders may vary by insurance company, so be sure to inquire about the options offered.

By considering these factors, you can tailor your life insurance policy to meet your family’s financial needs, protect against unforeseen expenses, and achieve your long-term financial goals. It’s advisable to consult with a knowledgeable insurance agent or financial advisor to help you navigate these considerations and make informed decisions about your life insurance coverage.

What Happens to My Life Insurance if I Can’t Afford My Premiums?

Life insurance is a vital tool for ensuring the financial security of your loved ones in the event of your passing. However, it’s important to remember that life insurance is an ongoing financial commitment, not a one-time cost. Some individuals may struggle to continue paying their life insurance premiums as life circumstances change. Here’s what you need to know if you’re facing difficulties in affording your life insurance premiums:

- Risk of Lapse: Your life insurance coverage could lapse if premium payments are missed. This means your policy would no longer be in force, and your beneficiaries would not receive the death benefit if you were to pass away.

- Policy Riders: Some life insurance policies offer riders that can exempt you from premium payments under specific conditions. For example, disability or critical illness riders can provide relief from premiums in the event of certain health-related issues. Check your policy to see if these options are available to you.

- Cash Value Component: Whole life insurance policies typically include a cash value component that grows over time. In financially challenging times, you can temporarily use the accumulated cash value to cover premium costs. Be aware that using the cash value in this way can reduce the policy’s death benefit.

- Life Settlements: Life settlements can be an option if you’re above a certain age, often around 65, and your life insurance policy meets specific criteria. You can receive an immediate cash payout by selling your policy to a third party. This can be an attractive option if you no longer need the coverage or are struggling to afford the premiums.

- Viatical Settlements: Viatical settlements are specifically designed to provide financial relief for individuals with life threatening illnesses. In a viatical settlement, you can sell your life insurance policy for a percentage of its death benefit, which can help cover medical expenses and improve your quality of life during a challenging time.

It’s important to explore your options and communicate with your insurance provider if you face premium payment difficulties. They can offer solutions or alternatives to help you maintain your coverage. Consulting with a financial advisor or insurance expert can guide you on the best course of action based on your circumstances and needs.