About American Life Fund

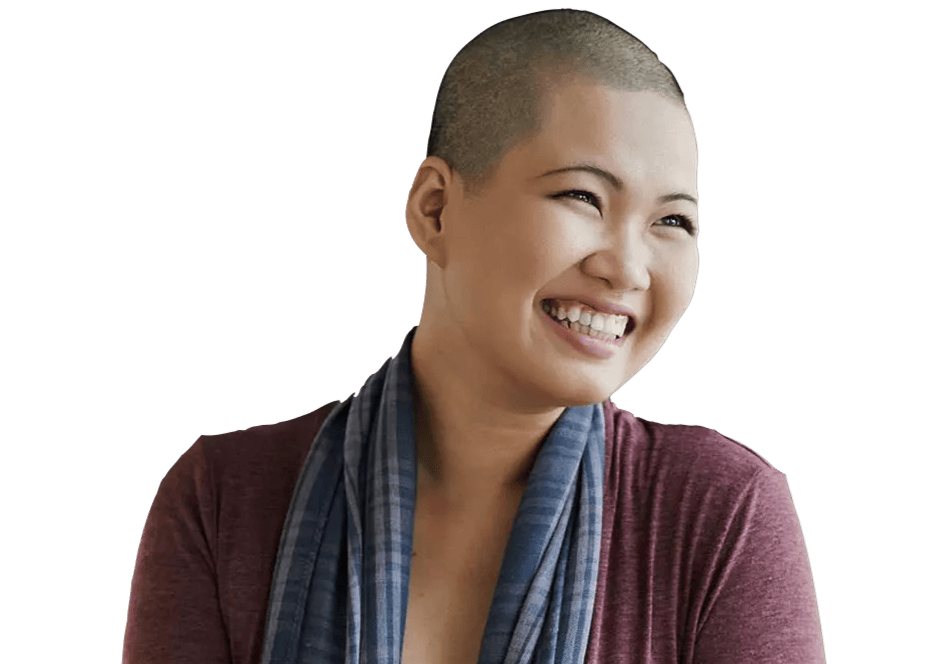

At American Life Fund, we take pride in being at the forefront of the viatical settlement industry, providing compassionate assistance to individuals facing late-stage cancer or other life-threatening illnesses. Over the years, we’ve extended our support to countless individuals, helping them secure immediate cash through a process known as a viatical settlement, leveraging the value of their existing life insurance policy.

Our commitment extends beyond financial transactions; at American Life Fund, we believe in empowering cancer patients by offering education on their diverse financial options. One such invaluable option is accessing your life insurance policy funds through a viatical settlement. We understand the complexities and challenges of a serious health diagnosis, and we aim to simplify this aspect of the journey.

A viatical settlement with us is more than just a transaction; it’s a seamless, swift, and stress-free avenue to obtain the necessary cash to address pressing needs such as medical bills, daily living expenses, and alternative treatments. We recognize the importance of providing a financial solution and a supportive and understanding approach during a challenging time. Let us guide you through this process with care and dedication, ensuring you have the resources to navigate your unique circumstances.

How Does The Viatical Process Work?

Do you need a viatical settlement company? A viatical settlement can be defined as the sale of an existing life insurance policy to a third party for more than its surrender value but less than its net death benefit. Your existing insurance policy can hold the key when it comes to receiving funds to pay off various expenses such as medical bills, future cancer treatments, living expenses, and medications.

If you have an existing life insurance policy with a face amount of $100,000 or higher and have a life-threatening disease, please call American Life Fund to assist you in selling your policy.

What Can a Viatical Settlement do?

Viatical Settlements serve as a valuable source of financial assistance, offering support to cover a wide range of expenses that may arise in the face of a cancer diagnosis. When confronted with the challenges of medical bills, medication costs, cancer care, and everyday necessities, the financial strain can be overwhelming.

In recognizing the multifaceted nature of healthcare expenses, it’s crucial to understand that your life insurance policy is a protective measure and a tangible asset you possess. Despite the presence of health insurance and government programs like Medicare and Medicaid, individuals dealing with severe medical conditions often find themselves contending with significant out-of-pocket costs in the United States.

What many may not realize is that a life insurance policy holds the potential to provide substantial financial relief. As policyholders, you can transform this asset into a lifeline through a viatical settlement. You can sell your life insurance for a lump-sum cash payment. This process allows you to unlock the inherent value of your policy, providing the financial resources needed to navigate the complexities of your health journey with greater ease and assurance.